Indian Accounting Standard 101

Uploaded by

RITZ BROWNIndian Accounting Standard 101

Uploaded by

RITZ BROWNINDIAN ACCOUNTING STANDARD 101 6.

13

An entity is not required to undertake an exhaustive search for information when

determining, at the date of transition to Ind AS, whether there have been significant

increases in credit risk since initial recognition.

If, at the date of transition to Ind ASs, determining whether there has been a

significant increase in credit risk since the initial recognition of a financial instrument

would require undue cost or effort, an entity shall recognise a loss allowance at an

amount equal to lifetime expected credit losses at each reporting date until that

financial instrument is derecognised, unless that financial instrument is low credit risk

at a reporting date.

7. Embedded derivatives

A first-time adopter shall assess whether an embedded derivative is required to be

separated from the host contract and accounted for as a derivative on the basis of the

conditions that existed at the later of (a) the date it first became a party to the contract and

(b) the date a reassessment is required by Ind AS 109 i.e. when there is a change in the

terms of the contract that significantly modifies the cash flows that otherwise would be

required under the contract.

8. Government loans

A first-time adopter shall classify all government loans received as a financial liability or an

equity instrument in accordance with Ind AS 32, Financial Instruments: Presentation.

A first-time adopter shall apply the requirements in Ind AS 109, Financial Instruments, and

Ind AS 20, Accounting for Government Grants and Disclosure of Government Assistance,

prospectively to government loans existing at the date of transition to Ind AS and shall

not recognise the corresponding benefit of the government loan at a below-market rate

of interest as a government grant.

Example 4

Government of India provides loans to MSMEs at a below-market rate of interest to fund the

set-up of a new manufacturing facility.

Company A‟s date of transition to Ind AS is 1 April 20X5.

In 20X2, Company A had received a loan of ` 1 crore at a below-market rate of interest from

the government. Under Indian GAAP, Company A accounted for the loan as equity and the

carrying amount was ` 1 crore at the date of transition. The amount repayable at 31 March

20X9 will be ` 1.25 crore.

The loan meets the definition of a financial liability in accordance with I nd AS 32. Company

A therefore reclassifies it from equity to liability. It also uses the previous GAAP carrying

amount of the loan at the date of transition as the carrying amount of the loan in the opening

© The Institute of Chartered Accountants of India

6.14 FINANCIAL REPORTING

Ind AS balance sheet. It calculates the annual effective interest rate (EIR) starting 1 April

20X5 as below:

EIR = Amount / Principal (1/t) i.e. 1.25/1 (1/4) i.e. 5.74%. approx.

At this rate, ` 1 crore will accrete to ` 1.25 crore as at 31 March 20X9.

During the next 4 years, the interest expense charged to statement of profit and loss shall be :

Year ended Opening amortised Interest expense Closing amortised

cost (`) for the year (`) @ cost (`)

5.74% p.a. approx.

31 March 20X6 1,00,00,000 5,73,713 1,05,73,713

31 March 20X7 1,05,73,713 6,06,627 1,11,80,340

31 March 20X8 1,11,80,340 6,41,430 1,18,21,770

31 March 20X9 1,18,21,770 6,78,230 1,25,00,000

Calculations have been done on full scale calculator. However, in case calculations are done

taking EIR as exact 5.74%, then there will be difference of a few ` due to rounding off.

An entity may apply the requirements in Ind AS 109 and Ind AS 20 retrospectively to any

government loan originated before the date of transition to Ind AS, provided that the

information needed to do so had been obtained at the time of initially accounting for that loan.

6.2 Optional exemptions from retrospective application of other Ind AS

1. Business combination

Ind AS 103 need not be applied to business combinations before date of transition. But, if

one business combination is restated to comply with Ind AS 103, all subsequent business

combinations are restated.

When the exemption is used:

There won‟t be any change in classification from previous GAAP.

For example, if the “pooling of interests” method is applied as per AS 14, the

balances of assets and liabilities arising therefrom shall be carried forward.

Another example is regarding the identification of the acquirer – irrespective of the

fact that a business combination could have been a reverse acquisition as per Ind AS

103, the accounting adopted in previous GAAP shall be continued.

© The Institute of Chartered Accountants of India

6.36 FINANCIAL REPORTING

Inventory 8,00,000 8,00,000

Financial assets:

Investment in S Ltd. 2 48,00,000 20,00,000 68,00,000

Trade Receivables 2,00,000 2,00,000

Cash 49,000 49,000

Other current asset –

(Advances for purchase

of inventory) 50,00,000 50,00,000

Total assets 2,42,99,000 20,00,000 2,62,99,000

Share capital 1,30,00,000 1,30,00,000

Other Equity:

Cumulative translation 5

difference 1,00,000 (1,00,000) 0

ESOP reserve 4 20,000 1,000 21,000

Retained earnings 6 1,79,000 20,99,000 22,78,000

Total equity 1,32,99,000 20,00,000 1,52,99,000

Non-current Liabilities

Financial liability:

VAT deferral loan 3 60,00,000 (22,74,472) 37,25,528

Deferred government grant 3 0 22,74,472 22,74,472

Current Liabilities

Financial Liabilities

Trade payables 30,00,000 30,00,000

Short term borrowings 8,00,000 8,00,000

Provisions 12,00,000 12,00,000

Total liabilities 1,10,00,000 1,10,00,000

Total equity and liabilities 2,42,99,000 20,00,000 2,62,99,000

*****

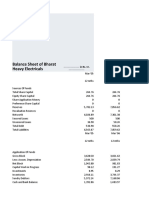

Illustration 17

Shaurya Limited is the company having its registered and corporate office at New Delhi.

60% of Shaurya Limited’s shares are held by the Government of India and rest by other

investors.

This is the first time that Shaurya limited would be applying Ind AS for the preparation of its

financials for the current financial year 2019-2020. Following balance sheet is prepared as

per earlier GAAP as at the beginning of the preceding period along with the additional

information:

© The Institute of Chartered Accountants of India

INDIAN ACCOUNTING STANDARD 101 6.37

Balance Sheet as at 31 March 2018

(All figures are in ’000, unless otherwise specified)

Particulars Amount

EQUITY AND LIABILITIES

(1) Shareholders’ Funds

(a) Share Capital 10,00,000

(b) Reserves & Surplus 25,00,000

(2) Non-Current Liabilities

(a) Long Term Borrowings 4,50,000

(b) Long Term Provisions 3,50,000

(c) Deferred tax liabilities 3,50,000

(3) Current Liabilities

(a) Trade Payables 22,00,000

(b) Other Current Liabilities 4,50,000

(c) Short Term Provisions 12,00,000

TOTAL 85,00,000

ASSETS

(1) Non-Current Assets

(a) Property, Plant & Equipment (net) 20,00,000

(b) Intangible assets 2,00,000

(c) Goodwill 1,00,000

(d) Non-current Investments 5,00,000

(e) Long Term Loans and Advances 1,50,000

(f) Other Non-Current Assets 2,00,000

(2) Current Assets

(a) Current Investments 18,00,000

(b) Inventories 12,50,000

(c) Trade Receivables 9,00,000

(d) Cash and Bank Balances 10,00,000

(e) Other Current Assets 4,00,000

TOTAL 85,00,000

Additional Information (All figures are in ’000) :

1. Other current liabilities include ` 3,90,000 liabilities to be paid in cash such as

expense payable, salary payable etc. and ` 60,000 are statutory government dues.

© The Institute of Chartered Accountants of India

6.38 FINANCIAL REPORTING

2. Long term loans and advances include ` 40,000 loan and the remaining amount

consists Advance to staff of ` 1,10,000.

3. Other non-current assets of ` 2,00,000 consists Capital advances to suppliers.

4. Other current assets include ` 3,50,000 current assets receivable in cash and Prepaid

expenses of ` 50,000.

5. Short term provisions include Dividend payable of ` 2,00,000. The dividend payable

had been as a result of board meeting wherein the declaration of dividend for financial

year 2017-2018 was made. However, it is subject to approval of shareholders in the

annual general meeting.

Chief financial officer of Shaurya Limited has also presented the following information

against corresponding relevant items in the balance sheet:

a) Property, Plant & Equipment consists a class of assets as office buildings whose

carrying amount is ` 10,00,000. However, the fair value of said office building as on

the date of transition is estimated to be ` 15,00,000. Company wants to follow

revaluation model as its accounting policy in respect of its property, plant and

equipment for the first annual Ind AS financial statements.

b) The fair value of Intangible assets as on the date of transition is estimated to be

` 2,50,000. However, the management is reluctant to incorporate the fair value

changes in books of account.

c) Shaurya Ltd. had acquired 80% shares in a company, Excel private limited few years

ago thereby acquiring the control upon it at that time. Shaurya Ltd. recognised

goodwill as per erstwhile accounting standards by accounting the excess of

consideration paid over the net assets acquired at the date of acquisition. Fair value

exercise was not done at the time of acquisition.

d) Trade receivables include an amount of ` 20,000 as provision for doubtful debts

measured in accordance with previous GAAP. Now as per latest estimates using

hindsights, the provision needs to be revised to ` 25,000.

e) Company had given a loan of ` 1,00,000 to an entity for the term of 10 years six years

ago. Transaction costs were incurred separately for this loan. The loan carries an

interest rate of 7%. The principal amount is to be repaid in equal installments over the

period of ten years at the year end. Interest is also payable at each year end. The

fair value of loan as on the date of transition is ` 50,000 as against the carrying

amount of loan which at present amounts to ` 40,000. However, Ind AS 109

mandates to recognise the interest income as per effective interest method after the

adjustment of transaction costs. Management says it is tedious task in the given case

to apply the effective interest rate changes with retrospective effect and hence is

reluctant to apply the same retrospectively in its first time adoption.

© The Institute of Chartered Accountants of India

INDIAN ACCOUNTING STANDARD 101 6.39

f) In the long-term borrowings, ` 4,50,000 of component is due towards the State

Government. Interest is payable on the government loan at 4%, however the

prevailing rate in the market at present is 8%. The fair market value of loan stands at

` 4,20,000 as on the relevant date.

g) Under Previous GAAP, the mutual funds were measured at cost or market value,

whichever is lower. Under Ind AS, the Company has designated these investments at

fair value through profit or loss. The value of mutual funds as per previous GAAP is

` 2,00,000 as included in ‘current investment’. However, the fair value of mutual

funds as on the date of transition is ` 2,30,000.

h) Ignore separate calculation of deferred tax on above adjustments. Assume the net

deferred tax income to be ` 50,000 on account of Ind AS transition adjustments.

Requirements:

- Prepare transition date balance sheet of Shaurya Limited as per Indian Accounting

Standards

- Show necessary explanation for each of the items presented by chief financial officer

in the form of notes, which may or may not require the adjustment as on the date of

transition.

Solution

Transition date (opening) IND-AS BALANCE SHEET of SHAURYA LIMITED

As at 1 April 2018

(All figures are in ‟000, unless otherwise specified)

Particulars Previous Transitional Opening Ind

GAAP Ind AS AS Balance

adjustments Sheet

ASSETS

Non-current assets

Property, plant and equipment (Note 1) 20,00,000 5,00,000 25,00,000

Goodwill (Note 2) 1,00,000 - 1,00,000

Other Intangible assets (Note 3) 2,00,000 - 2,00,000

Financial assets:

Investment 5,00,000 - 5,00,000

Loans (Note 4) 40,000 10,000 50,000

Other financial assets 1,10,000 - 1,10,000

Other non-current assets 2,00,000 - 2,00,000

Current assets

Inventories 12,50,000 - 12,50,000

© The Institute of Chartered Accountants of India

6.40 FINANCIAL REPORTING

Financial assets

Investment (Note 5) 18,00,000 30,000 18,30,000

Trade receivables (Note 6) 9,00,000 - 9,00,000

Cash and cash 10,00,000 - 10,00,000

equivalents/Bank

Other financial assets 3,50,000 - 3,50,000

Other current assets 50,000 - 50,000

TOTAL ASSETS 85,00,000 5,40,000 90,40,000

EQUITY AND LIABILITIES

Equity

Equity share capital 10,00,000 - 10,00,000

Other equity 25,00,000 7,90,000 32,90,000

Non-current liabilities

Financial liabilities

Borrowings (Note-7) 4,50,000 - 4,50,000

Provisions 3,50,000 - 3,50,000

Deferred tax liabilities (Net) 3,50,000 (50,000) 3,00,000

Current liabilities

Financial liabilities

Trade payables 22,00,000 - 22,00,000

Other financial liabilities 3,90,000 - 3,90,000

Other current liabilities 60,000 - 60,000

Provisions (Note-8) 12,00,000 (2,00,000) 10,00,000

TOTAL EQUITY AND LIABILITIES 85,00,000 5,40,000 90,40,000

OTHER EQUITY

Retained Earnings (`) Fair value reserve Total

As at 31 March, 2018 27,90,000 (W.N.1) 5,00,000 32,90,000

Working Note 1:

Retained earnings balance:

Balance as per Earlier GAAP 25,00,000

Transitional adjustment due to loan‟s fair value 10,000

© The Institute of Chartered Accountants of India

INDIAN ACCOUNTING STANDARD 101 6.41

Transitional adjustment due to increase in mutual fund‟s fair value 30,000

Transitional adjustment due to decrease in deferred tax liability 50,000

Transitional adjustment due to decrease in provisions (dividend) 2,00,000

Total 27,90,000

Disclosure forming part of financial statements:

Proposed dividend on equity shares is subject to the approval of the shareholders of the

company at the annual general meeting and should not recognized as liability as at the Balance

Sheet date.

Note 1: Property, plant & Equipment:

As per para D5 of Ind AS 101, an entity may elect to measure an item of property, plant and

equipment at the date of transition to Ind AS at its fair value and use that fair value as its

deemed cost at that date.

Para D7AA has to be applied for all items of property, plant and equipment. So, if D5 exemp tion

is taken for buildings, Ind AS will have to be applied retrospectively for other assets as well.

Since, an entity elect to measure an item of property, plant and equipment at the date of

transition to Ind AS at its fair value and use that fair value as its deemed cost at that date, it is

assumed that the carrying amount of other assets based on retrospective application of Ind AS

is equal to their fair value of ` 10 lakhs.

Note 2: Goodwill:

Ind AS 103 mandatorily requires measuring the assets and liabilities of the acquiree at its fair

value as on the date of acquisition. However, a first time adopter may elect to not apply the

provisions of Ind AS 103 with retrospective effect that occurred prior to the date of transition to

Ind AS.

Hence company can continue to carry the goodwill in its books of account as per the previous

GAAP.

Note 3: Intangible assets:

Para D7 read with D6 of Ind AS 101 states that a first-time adopter may elect to use a previous

GAAP revaluation at, or before, the date of transition to Ind AS as deemed cost at the date of

the revaluation, if the revaluation was, at the date of the revaluation, broadly comparable to:

(a) Fair value; or

(b) Cost or depreciated cost in accordance with Ind AS, adjusted to reflect, f or example,

changes in a general or specific price index.

However, there is a requirement that Intangible assets must meet the definition and recognition

© The Institute of Chartered Accountants of India

6.42 FINANCIAL REPORTING

criteria as per Ind AS 38.

Hence, company can avail the exemption given in Ind AS 101 as on the date of transition to use

the carrying value as per previous GAAP.

Note 4: Loan:

Para B8C of Ind AS 101 states that if it is impracticable (as defined in Ind AS 8) for an entity to

apply retrospectively the effective interest method in Ind AS 109, the fair value of the financial

asset or the financial liability at the date of transition to Ind ASs shall be the new gross carrying

amount of that financial asset or the new amortised cost of that financial liability at the date of

transition to Ind AS.

Accordingly, ` 50,000 would be the gross carrying amount of loan and difference of ` 10,000 (`

50,000 – ` 40,000) would be adjusted to retained earnings.

Note 5: Mutual Funds:

Para 29 of Ind AS 101 states that an entity is permitted to designate a previously recognised

financial asset as a financial asset measured at fair value through profit or loss in accordance

with paragraph D19A. The entity shall disclose the fair value of financial assets so designated

at the date of designation and their classification and carrying amount in the previous financial

statements.

D19A states that an entity may designate a financial asset as measured at fair value through

profit or loss in accordance with Ind AS 109 on the basis of the facts and circumstances that

exist at the date of transition to Ind AS.

Note 6: Trade receivables:

Para 14 of Ind AS 101 states that an entity‟s estimates in accordance with Ind AS at the date of

transition to Ind AS shall be consistent with estimates made for the same date in accordance

with previous GAAP (after adjustments to reflect any difference in accounting policies), unless

there is objective evidence that those estimates were in error.

Para 15 of Ind AS 101 further states that an entity may receive information after the date of

transition to Ind AS about estimates that it had made under previous GAAP. In accordance with

paragraph 14, an entity shall treat the receipt of that information in the same way as non -

adjusting events after the reporting period in accordance with Ind AS 10, Events after the

Reporting Period.

The entity shall not reflect that new information in its opening Ind AS Balance Sheet (unless the

estimates need adjustment for any differences in accounting policies or there is objective

evidence that the estimates were in error). Instead, the entity shall reflect that new information in

profit or loss (or, if appropriate, other comprehensive income) for the year ended 31 March

2019.

© The Institute of Chartered Accountants of India

INDIAN ACCOUNTING STANDARD 101 6.43

Note 7: Government Grant:

Para 10A of Ind AS 20 states that the benefit of a government loan at a below-market rate of

interest is treated as a government grant. The loan shall be recognised and measured in

accordance with Ind AS 109, Financial Instruments. The benefit of the below -market rate of

interest shall be measured as the difference between the initial carrying value of the loan

determined in accordance with Ind AS 109, and the proceeds received. The benefit is

accounted for in accordance with this Standard.

However, Para B10 of Ind AS 101 states, a first-time adopter shall classify all government loans

received as a financial liability or an equity instrument in accordance with Ind AS 32, Financial

Instruments: Presentation. Except as permitted by paragraph B11, a first -time adopter shall

apply the requirements in Ind AS 109, Financial Instruments, and Ind AS 20, Accounting for

Government Grants and Disclosure of Government Assistance, prospectively to government

loans existing at the date of transition to Ind ASs and shall not recognise the corresponding

benefit of the government loan at a below-market rate of interest as a government grant.

Consequently, if a first-time adopter did not, under its previous GAAP, recognise and measure a

government loan at a below-market rate of interest on a basis consistent with Ind AS

requirements, it shall use its previous GAAP carrying amount of the loan at the date of transition

to Ind AS as the carrying amount of the loan in the opening Ind AS Balance Sheet. An entity

shall apply Ind AS 109 to the measurement of such loans after the date of transition to Ind AS.

Note 8: Dividend

Dividend should be deducted from retained earnings during the year when it has been declared

and approved. Accordingly, the provision declared for preceding year should be reversed (to

rectify the wrong entry). Retained earnings would increase proportionately due to such

adjustment.

*****

8. CARVE OUTS IN IND AS 101 FROM IFRS 1

(i) Definition of previous GAAP under Ind AS 101

As per IFRS

IFRS 1 defines previous GAAP as the basis of accounting that a first - time adopter used

immediately before adopting IFRS.

Carve out

Ind AS 101 defines previous GAAP as the basis of accounting that a first -time adopter used

for its reporting requirement in India immediately before adopting Ind AS. The change

made it mandatory for Indian entities to consider the financial statements prepared in

© The Institute of Chartered Accountants of India

INDIAN ACCOUNTING STANDARD 101 6.47

TEST YOUR KNOWLEDGE

Questions

1. Company A intends to restate its past business combinations with effect from 30 June 20X0

(being a date prior to the transition date). If business combinations are restated, whether

certain other exemptions, such as the deemed cost exemption for property, plant and

equipment (PPE), can be adopted?

2. X Ltd. was using cost model for its property, plant and equipment till March 31, 20 X2 under

previous GAAP. The Ind AS become applicable to the company for financial year

beginning April 1, 20X2. On April 1, 20X1, i.e., the date of its transition to Ind AS, it used

fair value as the deemed cost in respect of its property, plant and equipment. X Ltd. wants

to follow revaluation model as its accounting policy in respect of its property, plant and

equipment for the first annual Ind AS financial statements. Whether use of fair values as

deemed cost on the date of transition and use of revaluation model in the first annual Ind

AS financial statements would amount to a change in accounting policy?

3. Y Ltd. is a first time adopter of Ind AS. The date of transition is April 1, 20X5. On April 1,

20X0, it obtained a 7 year US $ 1,00,000 loan. It has been exercising the option provided

in Paragraph 46/46A of AS 11 and has been amortising the exchange differences in

respect of this loan over the balance period of such loan. On the date of transition to Ind

AS, Y Ltd. wants to discontinue the accounting policy as per the previous GAAP and follo w

the requirements of Ind AS 21 with respect to recognition of foreign exchange differences.

Whether the Company is permitted to do so?

4. A company has chosen to elect the deemed cost exemption in accordance with Ind AS 101.

However, it does not wish to continue with its existing policy of capitalising exchange

fluctuation on long term foreign currency monetary items to property, plant and equipment

i.e. it does not want to elect the exemption available as per Ind AS 101. In such a case,

how would the company be required to adjust the foreign exchange fluctuation already

capitalised to the cost of property, plant and equipment under previous GAAP?

5. XYZ Pvt. Ltd. is a company registered under the Companies Act, 2013 following Accounting

Standards notified under Companies (Accounting Standards) Rules, 2006. The Company

has decided to voluntarily adopt Ind AS w.e.f 1 st April, 20X2 with a transition date of

1 st April, 20X1.

The Company has one Wholly Owned Subsidiary and one Joint Venture which are into

manufacturing of automobile spare parts.

© The Institute of Chartered Accountants of India

6.48 FINANCIAL REPORTING

The consolidated financial statements of the Company under Indian GAAP are as under:

Consolidated Financial Statements

(` in Lakhs)

Particulars 31.03.20X2 31.03.20X1

Shareholder's Funds

Share Capital 7,953 7,953

Reserves & Surplus 16,547 16,597

Non-Current Liabilities

Long Term Borrowings 1,000 1,000

Long Term Provisions 1,101 691

Other Long-Term Liabilities 5,202 5,904

Current Liabilities

Trade Payables 9,905 8,455

Short Term Provisions 500 475

Total 42,208 41,075

Non-Current Assets

Property Plant & Equipment 21,488 22,288

Goodwill on Consolidation of subsidiary and JV 1,507 1,507

Investment Property 5,245 5,245

Long Term Loans & Advances 6,350 6,350

Current Assets

Trade Receivables 4,801 1,818

Investments · 1,263 3,763

Other Current Assets 1,554 104

Total 42,208 41,075

Additional Information:

The Company has entered into a joint arrangement by acquiring 50% of the equity shares

of ABC Pvt. Ltd. Presently, the same has been accounted as per the proportionate

consolidated method. The proportionate share of assets and liabilities of ABC Pvt. Ltd.

included in the consolidated financial statement of XYZ Pvt. Ltd. is as under:

Particulars ` in Lakhs

Property, Plant & Equipment 1,200

Long Term Loans & Advances 405

Trade Receivables 280

Other Current Assets 50

© The Institute of Chartered Accountants of India

INDIAN ACCOUNTING STANDARD 101 6.49

Trade Payables 75

Short Term Provisions 35

The Investment is in the nature of Joint Venture as per Ind AS 111.

The Company has approached you to advice and suggest the accounting adjustments

which are required to be made in the opening Balance Sheet as on 1st April, 20X1.

6. Mathur India Private Limited has to present its first financials under Ind AS for the year ended

31st March, 20X3. The transition date is 1 st April, 20X1.

The following adjustments were made upon transition to Ind AS:

(a) The Company opted to fair value its land as on the date on transition.

The fair value of the land as on 1 st April, 20X1 was ` 10 crores. The carrying amount as on

1 st April, 20X1 under the existing GAAP was ` 4.5 crores.

(b) The Company has recognised a provision for proposed dividend of ` 60 lacs and

related dividend distribution tax of ` 18 lacs during the year ended 31 st March, 20X1.

It was written back as on opening balance sheet date.

(c) The Company fair values its investments in equity shares on the date of transition.

The increase on account of fair valuation of shares is ` 75 lacs.

(d) The Company has an Equity Share Capital of ` 80 crores and Redeemable

Preference Share Capital of ` 25 crores.

(e) The reserves and surplus as on 1 st April, 20X1 before transition to Ind AS was

` 95 crores representing ` 40 crores of general reserve and ` 5 crores of capital

reserve acquired out of business combination and balance is surplus in the Retained

Earnings.

(f) The company identified that the preference shares were in nature of financial

liabilities.

What is the balance of total equity (Equity and other equity) as on 1 st April, 20X1 after transition

to Ind AS? Show reconciliation between total equity as per AS (Accounting Standards) and as

per Ind AS to be presented in the opening balance sheet as on 1 st April, 20X1.

Ignore deferred tax impact.

7. ABC Ltd is a government company and is a first-time adopter of Ind AS. As per the

previous GAAP, the contributions received by ABC Ltd. from the government (which holds

100% shareholding in ABC Ltd.) which is in the nature of promoters‟ contribution have been

recognised in capital reserve and treated as part of shareholders‟ funds in accordance with

the provisions of AS 12, Accounting for Government Grants.

© The Institute of Chartered Accountants of India

6.50 FINANCIAL REPORTING

State whether the accounting treatment of the grants in the nature of promoters‟

contribution as per AS 12 is also permitted under Ind AS 20 Accounting for Government

Grants and Disclosure of Government Assistance. If not, then what will be the accounting

treatment of such grants recognised in capital reserve as per previous GAAP on the date of

transition to Ind AS.

Answers

1. Ind-AS 101 prescribes that an entity may elect to use one or more of the exemptions of the

Standard. As such, an entity may choose to adopt a combination of optional exemptions in

relation to the underlying account balances.

When the past business combinations after a particular date (30 June 20X0 in the given

case) are restated, it requires retrospective adjustments to the carrying amounts of

acquiree‟s assets and liabilities on account of initial acquisition accounting of the acquiree‟s

net assets, the effects of subsequent measurement of those net assets (including

amortisation of non-current assets that were recognised at its fair value), goodwill on

consolidation and the consolidation adjustments. Therefore, the goodwill and equity

(including non-controlling interest (NCI)) cannot be computed by considering the deemed

cost exemption for PPE. However, the entity may adopt the deemed cost exemption for its

property, plant and equipment other than those acquired through business combinations.

2. In the instant case, X Ltd. is using revaluation model for property, plant and equipment for

the first annual Ind AS financial statements and using fair value of property, plant and

equipment on the date of the transition, as deemed cost. Since the entity is using fair value

at the transition date as well as in the first Ind AS financial statements, there is no change

in accounting policy and mere use of the term „deemed cost‟ would not mean that there is a

change in accounting policy.

3. Ind AS 101 provides that a first-time adopter may continue the policy adopted for

accounting for exchange differences arising from translation of long-term foreign currency

monetary items recognised in the financial statements for the period ending immediately

before the beginning of the first Ind AS financial reporting period as per the previous

GAAP. Ind AS 101 gives an option to continue the existing accounting policy. Hence, Y

Ltd. may opt for discontinuation of accounting policy as per previous GAAP and follow the

requirements of Ind AS 21. The cumulative amount lying in the Foreign Currency Monetary

Item Translation Difference Account (FCMITDA) as per AS 11 should be derecognised by

an adjustment against retained earnings on the date of transition.

4. Ind AS 101 permits to continue with the carrying value for all of its property, plant and

equipment as per the previous GAAP and use that as deemed cost for the purposes of first

time adoption of Ind AS. Accordingly, the carrying value of property, plant and equipment

as per previous GAAP as at the date of transition need not be adjusted for the exchange

fluctuations capitalized to property, plant and equipment. Separately, it allows a company

© The Institute of Chartered Accountants of India

INDIAN ACCOUNTING STANDARD 101 6.51

to continue with its existing policy for accounting for exchange differences arising from

translation of long term foreign currency monetary items recognised in the financial

statements for the period ending immediately before the beginning of the first Ind AS

financial reporting period as per the previous GAAP. Accordingly, given that Ind AS 101

provides these two choices independent of each other, it may be possible for an entity to

choose the deemed cost exemption for all of its property, plant and equipment and not

elect the exemption of continuing the previous GAAP policy of capitalising exchange

fluctuation to property, plant and equipment. In such a case, in the given case, a

harmonious interpretation of the two exemptions would require the company to recognise

the property, plant and equipment at the transition date at the previous GAAP carrying

value (without any adjustment for the exchanges differences capitalized under previou s

GAAP) but for the purposes of the first (and all subsequent) Ind AS financial statements,

foreign exchange fluctuation on all long term foreign currency borrowings that arose after

the transition date would be recognised in the statement of profit and loss.

5. As per paras D31AA and D31AB of Ind AS 101, when changing from proportionate

consolidation to the equity method, an entity shall recognise its investment in the joint

venture at transition date to Ind AS.

That initial investment shall be measured as the aggregate of the carrying amounts of the

assets and liabilities that the entity had previously proportionately consolidated, including

any goodwill arising from acquisition. If the goodwill previously belonged to a larger cash-

generating unit, or to a group of cash-generating units, the entity shall allocate goodwill to

the joint venture on the basis of the relative carrying amounts of the joint venture and the

cash-generating unit or group of cash-generating units to which it belonged. The balance

of the investment in joint venture at the date of transition to Ind AS, determined in

accordance with paragraph D31AA above is regarded as the deemed cost of the

investment at initial recognition.

Accordingly, the deemed cost of the investment will be

Property, Plant & Equipment 1,200

Goodwill (Refer Note below) 119

Long Term Loans & Advances 405

Trade Receivables 280

Other Current Assets 50

Total Assets 2,054

Less: Trade Payables 75

Short Term Provisions 35

Deemed cost of the investment in JV 1,944

© The Institute of Chartered Accountants of India

6.52 FINANCIAL REPORTING

Calculation of proportionate goodwill share of Joint Venture ie ABC Pvt. Ltd.

Property, Plant & Equipment 22,288

Goodwill 1,507

Long Term Loans & Advances 6,350

Trade Receivables 1,818

Other Current Assets 104

Total Assets 32,067

Less: Trade Payables 8,455

Short Term Provisions 475

23,137

Note: Only those assets and liabilities have been taken into account for calculation of

„proportionate goodwill share of Joint Venture‟, which were given in the question as

„proportionate share of assts and liabilities of ABC Ltd. added to XYZ Ltd.‟

Proportionate Goodwill of Joint Venture

= [(Goodwill on consolidation of subsidiary and JV/Total relative net asset) x Net asset

of JV]

= (1507 / 23,137) x 1825 = 119 (approx.)

Accordingly, the proportional share of assets and liabilities of Joint Venture will be removed

from the respective values assets and liabilities appearing in the balance sheet on

31.3.20X1 and Investment in JV will appear under non-current asset in the transition date

balance sheet as on 1.4.20X1.

Adjustments made in previous GAAP balance sheet to arrive at Transition date Ind AS

Balance Sheet

Transition Date Ind AS Balance Sheet of XYZ Pvt. Ltd. as at 1st April, 20X1

Particulars Previous Ind AS Ind AS GAAP

GAAP Adjustment

Non-Current Assets

Property, Plant & Equipment 22,288 (1,200) 21,088

Investment Property 5,245 - 5,245

Intangible assets - Goodwill on 1,507 (119) 1,388

Consolidation

Financial Assets

Long Term Loans & Advances 6,350 (405) 5,945

Non- current investment in JV - 1,944 1,944

© The Institute of Chartered Accountants of India

INDIAN ACCOUNTING STANDARD 101 6.53

Current Assets -

Financial Assets

Investments · 3,763 - 3,763

Trade Receivables 1,818 (280) 1,538

Other Current Assets 104 (50) 54

Total 41,075 (110) 40,965

Equity and liabilities

Equity

Share Capital 7,953 - 7,953

Other equity 16,597 - 16,597

Non-Current Liabilities

Financial Liabilities

Borrowings 1,000 1,000

Long Term Provisions 691 691

Other Long-Term Liabilities 5,904 5,904

Current Liabilities

Financial Liabilities

Trade Payables 8,455 (75) 8,380

Short Term Provisions 475 (35) 440

Total 41,075 (110) 40,965

6. Computation of balance total equity as on 1 st April, 20X1 after transition to Ind AS

` in crore

Share capital- Equity share Capital 80

Other Equity

General Reserve 40

Capital Reserve 5

Retained Earnings (95-5-40) 50

Add: Increase in value of land (10-4.5) 5.5

Add: De recognition of proposed dividend (0.6 + 0.18) 0.78

Add: Increase in value of Investment 0.75 57.03 102.03

Balance total equity as on 1 st April, 20X1 after transition

to Ind AS 182.03

© The Institute of Chartered Accountants of India

6.54 FINANCIAL REPORTING

Reconciliation between Total Equity as per AS and Ind AS to be presented in the

opening balance sheet as on 1 st April, 20X1

` in crore

Equity share capital 80

Redeemable Preference share capital 25

105

Reserves and Surplus 95

Total Equity as per AS 200

Adjustment due to reclassification

Preference share capital classified as financial liability (25)

Adjustment due to derecognition

Proposed Dividend not considered as liability as on 1st April 20X1 0.78

Adjustment due to remeasurement

Increase in the value of Land due to remeasurement at fair value 5.5

Increase in the value of investment due to remeasurement at fair value 0.75 6.25

Equity as on 1 st April, 20X1 after transition to Ind AS 182.03

7. Paragraph 2 of Ind AS 20, “Accounting for Government Grants and Disclosure of

Government Assistance” inter alia states that the Standard does not deal with government

participation in the ownership of the entity.

Since ABC Ltd. is a Government company, it implies that government has 100%

shareholding in the entity. Accordingly, the entity needs to determine whether the payment

is provided as a shareholder contribution or as a government. Equity contributions will be

recorded in equity while grants will be shown in the Statement of Profit and Loss.

Where it is concluded that the contributions are in the nature of government grant, the

entity shall apply the principles of Ind AS 20 retrospectively as specified in Ind AS 101

„First Time Adoption of Ind AS‟. Ind AS 20 requires all grants to be recognised as income

on a systematic basis over the periods in which the entity recognises as expenses the

related costs for which the grants are intended to compensate. Unlike AS 12, Ind AS 20

requires the grant to be classified as either a capital or an income grant and does not

permit recognition of government grants in the nature of promoter‟s contribution directly to

shareholders‟ funds.

Where it is concluded that the contributions are in the nature of s hareholder contributions

and are recognised in capital reserve under previous GAAP, the provisions of paragraph 10

of Ind AS 101 would be applied which states that except in certain cases, an entity shall in

its opening Ind AS Balance Sheet:

© The Institute of Chartered Accountants of India

INDIAN ACCOUNTING STANDARD 101 6.55

(a) recognise all assets and liabilities whose recognition is required by Ind AS;

(b) not recognise items as assets or liabilities if Ind AS do not permit such recognition;

(c) reclassify items that it recognised in accordance with previous GAAP as one type of

asset, liability or component of equity, but are a different type of asset, liability or

component of equity in accordance with Ind AS; and

(d) apply Ind AS in measuring all recognised assets and liabilities.

Accordingly, as per the above requirements of paragraph 10(c) in the given case,

contributions recognised in the Capital Reserve should be transferred to appropriate

category under „Other Equity‟ at the date of transition to Ind AS.

© The Institute of Chartered Accountants of India

You might also like

- Practical Questions: Strategic Financial ManagementNo ratings yetPractical Questions: Strategic Financial Management50 pages

- Final Term Papers MGT201 - Solved Master File67% (3)Final Term Papers MGT201 - Solved Master File129 pages

- Paper - 1: Financial Reporting Questions Ind AS 103No ratings yetPaper - 1: Financial Reporting Questions Ind AS 10330 pages

- Delhi Public School Jodhpur: General InstructionsNo ratings yetDelhi Public School Jodhpur: General Instructions4 pages

- Test 6 - Complete Syllabus: Our Telegram Channel " "No ratings yetTest 6 - Complete Syllabus: Our Telegram Channel " "9 pages

- Paper-1 Financial Reporting Suggested Answers May 2025No ratings yetPaper-1 Financial Reporting Suggested Answers May 202531 pages

- Commerce (Regular) Accounting For Specialised Institutions (Group A: Accounting and Finance) Paper - 3.5 (A)No ratings yetCommerce (Regular) Accounting For Specialised Institutions (Group A: Accounting and Finance) Paper - 3.5 (A)4 pages

- 027 Practice Test 09 Accounting Test Solution Subjective Udesh RegularNo ratings yet027 Practice Test 09 Accounting Test Solution Subjective Udesh Regular6 pages

- Accounting For Debentures & Preference Shares Question No 15No ratings yetAccounting For Debentures & Preference Shares Question No 1533 pages

- Particulars Debit Credit: © The Institute of Chartered Accountants of IndiaNo ratings yetParticulars Debit Credit: © The Institute of Chartered Accountants of India46 pages

- Practice Test For Intermediate Accounting 3 - Compress100% (1)Practice Test For Intermediate Accounting 3 - Compress19 pages

- The Commerce Villa: Time: 1.5 Hour Marks: 40 Topic: Debentures & Financial Statements of A Company (AC - 06)No ratings yetThe Commerce Villa: Time: 1.5 Hour Marks: 40 Topic: Debentures & Financial Statements of A Company (AC - 06)11 pages

- p1 Accounting Solutions_e3f80b44 67b2 427b b4e9 7b541bfc2999No ratings yetp1 Accounting Solutions_e3f80b44 67b2 427b b4e9 7b541bfc2999170 pages

- Test Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: AccountingNo ratings yetTest Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: Accounting8 pages

- (In Lakhs) : © The Institute of Chartered Accountants of IndiaNo ratings yet(In Lakhs) : © The Institute of Chartered Accountants of India12 pages

- Question No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five QuestionsNo ratings yetQuestion No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five Questions7 pages

- Test 1 - Financial Statement, Buy Back of Securities & InvestmentNo ratings yetTest 1 - Financial Statement, Buy Back of Securities & Investment13 pages

- Chapter 4 - Financial Statements of CompaniesNo ratings yetChapter 4 - Financial Statements of Companies198 pages

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Indian Accounting Standard 12: © The Institute of Chartered Accountants of IndiaNo ratings yetIndian Accounting Standard 12: © The Institute of Chartered Accountants of India22 pages

- 5.9.2.6 Allocating Goodwill To Cash-Generating Units: Indian Accounting Standard 36No ratings yet5.9.2.6 Allocating Goodwill To Cash-Generating Units: Indian Accounting Standard 3616 pages

- Qualifying Asset: Qualifying Asset Is An Asset That Necessarily Takes A Substantial Period ofNo ratings yetQualifying Asset: Qualifying Asset Is An Asset That Necessarily Takes A Substantial Period of12 pages

- Indian Accounting Standard 105: © The Institute of Chartered Accountants of IndiaNo ratings yetIndian Accounting Standard 105: © The Institute of Chartered Accountants of India17 pages

- Financial Reporting: Cost of Investment Property50% (2)Financial Reporting: Cost of Investment Property11 pages

- 1.2 Objective: Financial Reporting Examples 1 & 2No ratings yet1.2 Objective: Financial Reporting Examples 1 & 28 pages

- Indian Accounting Standard 16: © The Institute of Chartered Accountants of IndiaNo ratings yetIndian Accounting Standard 16: © The Institute of Chartered Accountants of India7 pages

- Indian Accounting Standard 37: Contingent LiabilityNo ratings yetIndian Accounting Standard 37: Contingent Liability14 pages

- 3.3.1 Functions That Are Integral To Business: Financial Reporting SolutionNo ratings yet3.3.1 Functions That Are Integral To Business: Financial Reporting Solution15 pages

- © The Institute of Chartered Accountants of India: ST ST STNo ratings yet© The Institute of Chartered Accountants of India: ST ST ST14 pages

- Contents of An Interim Financial Report: Unit OverviewNo ratings yetContents of An Interim Financial Report: Unit Overview5 pages

- Audit May 2020 Rev Charts - Sandhiya SarafNo ratings yetAudit May 2020 Rev Charts - Sandhiya Saraf137 pages

- Financial Reporting: © The Institute of Chartered Accountants of IndiaNo ratings yetFinancial Reporting: © The Institute of Chartered Accountants of India7 pages

- Indian Accounting Standard 33 Diluted Earnings Per ShareNo ratings yetIndian Accounting Standard 33 Diluted Earnings Per Share3 pages

- Practical Questions: Derivatives Analysis and Valuation 7No ratings yetPractical Questions: Derivatives Analysis and Valuation 724 pages

- Paper - 2: Strategic Financial Management Questions Security ValuationNo ratings yetPaper - 2: Strategic Financial Management Questions Security Valuation21 pages

- Test Your Knowledge: 2.2.4.2 Pricing of SwaptionsNo ratings yetTest Your Knowledge: 2.2.4.2 Pricing of Swaptions11 pages

- Course Title: Financial Reporting and Analysis Course Code: FIN-454 Credit Hours: 3+0 Course Instructor: PrerequisitesNo ratings yetCourse Title: Financial Reporting and Analysis Course Code: FIN-454 Credit Hours: 3+0 Course Instructor: Prerequisites5 pages

- St. Paul University Surigao Surigao City, Philippines: Results and DiscussionsNo ratings yetSt. Paul University Surigao Surigao City, Philippines: Results and Discussions8 pages

- Corporate Finance Case Study: Square TextilesNo ratings yetCorporate Finance Case Study: Square Textiles47 pages

- IFRS PGC-NIRF Dec. 70.2009 22 Dez - Chat of AccountsNo ratings yetIFRS PGC-NIRF Dec. 70.2009 22 Dez - Chat of Accounts30 pages

- The Influence of Independent and Effective Audit Committees On Earnings QualityNo ratings yetThe Influence of Independent and Effective Audit Committees On Earnings Quality51 pages

- Practical Questions: Strategic Financial ManagementPractical Questions: Strategic Financial Management

- Paper - 1: Financial Reporting Questions Ind AS 103Paper - 1: Financial Reporting Questions Ind AS 103

- Test 6 - Complete Syllabus: Our Telegram Channel " "Test 6 - Complete Syllabus: Our Telegram Channel " "

- Paper-1 Financial Reporting Suggested Answers May 2025Paper-1 Financial Reporting Suggested Answers May 2025

- Commerce (Regular) Accounting For Specialised Institutions (Group A: Accounting and Finance) Paper - 3.5 (A)Commerce (Regular) Accounting For Specialised Institutions (Group A: Accounting and Finance) Paper - 3.5 (A)

- 027 Practice Test 09 Accounting Test Solution Subjective Udesh Regular027 Practice Test 09 Accounting Test Solution Subjective Udesh Regular

- Accounting For Debentures & Preference Shares Question No 15Accounting For Debentures & Preference Shares Question No 15

- Particulars Debit Credit: © The Institute of Chartered Accountants of IndiaParticulars Debit Credit: © The Institute of Chartered Accountants of India

- Practice Test For Intermediate Accounting 3 - CompressPractice Test For Intermediate Accounting 3 - Compress

- The Commerce Villa: Time: 1.5 Hour Marks: 40 Topic: Debentures & Financial Statements of A Company (AC - 06)The Commerce Villa: Time: 1.5 Hour Marks: 40 Topic: Debentures & Financial Statements of A Company (AC - 06)

- p1 Accounting Solutions_e3f80b44 67b2 427b b4e9 7b541bfc2999p1 Accounting Solutions_e3f80b44 67b2 427b b4e9 7b541bfc2999

- Test Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: AccountingTest Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: Accounting

- (In Lakhs) : © The Institute of Chartered Accountants of India(In Lakhs) : © The Institute of Chartered Accountants of India

- Question No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five QuestionsQuestion No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five Questions

- Test 1 - Financial Statement, Buy Back of Securities & InvestmentTest 1 - Financial Statement, Buy Back of Securities & Investment

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative Analysis

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth Edition

- Fast-Track Tax Reform: Lessons from the MaldivesFrom EverandFast-Track Tax Reform: Lessons from the Maldives

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom Line

- Indian Accounting Standard 12: © The Institute of Chartered Accountants of IndiaIndian Accounting Standard 12: © The Institute of Chartered Accountants of India

- 5.9.2.6 Allocating Goodwill To Cash-Generating Units: Indian Accounting Standard 365.9.2.6 Allocating Goodwill To Cash-Generating Units: Indian Accounting Standard 36

- Qualifying Asset: Qualifying Asset Is An Asset That Necessarily Takes A Substantial Period ofQualifying Asset: Qualifying Asset Is An Asset That Necessarily Takes A Substantial Period of

- Indian Accounting Standard 105: © The Institute of Chartered Accountants of IndiaIndian Accounting Standard 105: © The Institute of Chartered Accountants of India

- Indian Accounting Standard 16: © The Institute of Chartered Accountants of IndiaIndian Accounting Standard 16: © The Institute of Chartered Accountants of India

- Indian Accounting Standard 37: Contingent LiabilityIndian Accounting Standard 37: Contingent Liability

- 3.3.1 Functions That Are Integral To Business: Financial Reporting Solution3.3.1 Functions That Are Integral To Business: Financial Reporting Solution

- © The Institute of Chartered Accountants of India: ST ST ST© The Institute of Chartered Accountants of India: ST ST ST

- Contents of An Interim Financial Report: Unit OverviewContents of An Interim Financial Report: Unit Overview

- Financial Reporting: © The Institute of Chartered Accountants of IndiaFinancial Reporting: © The Institute of Chartered Accountants of India

- Indian Accounting Standard 33 Diluted Earnings Per ShareIndian Accounting Standard 33 Diluted Earnings Per Share

- Practical Questions: Derivatives Analysis and Valuation 7Practical Questions: Derivatives Analysis and Valuation 7

- Paper - 2: Strategic Financial Management Questions Security ValuationPaper - 2: Strategic Financial Management Questions Security Valuation

- Course Title: Financial Reporting and Analysis Course Code: FIN-454 Credit Hours: 3+0 Course Instructor: PrerequisitesCourse Title: Financial Reporting and Analysis Course Code: FIN-454 Credit Hours: 3+0 Course Instructor: Prerequisites

- St. Paul University Surigao Surigao City, Philippines: Results and DiscussionsSt. Paul University Surigao Surigao City, Philippines: Results and Discussions

- IFRS PGC-NIRF Dec. 70.2009 22 Dez - Chat of AccountsIFRS PGC-NIRF Dec. 70.2009 22 Dez - Chat of Accounts

- The Influence of Independent and Effective Audit Committees On Earnings QualityThe Influence of Independent and Effective Audit Committees On Earnings Quality